Would you like to snag a $25.00 gift card to Walgreens for your next prescription refill? I have a great Walgreens pharmacy printable coupons for you!

This is a GREAT offer and I have no problems with transferring my presciptions around town to whomever will offer the best deal. I’m on regular thryroid meds but you could do this with any prescription. Just transfer a prescription to Walgreens (even if there is only 1 refill left) and you’ll receive a gift card to Walgreens for $25.00! Then take that $25.00 Walgreens gift card and follow our Walgreens coupon match ups where we match ups coupons to the Walgreens sale circular each week and you’ll wind up with about $70.00 worth of products for that $25.00 gift card when you transferred your prescriptions!

Ok – so here’s what you do…. Click on the Walgreens pharmacy logo above. Then click on the pharmacy link and then enter in the info to transfer your prescription! Its that easy! To print out a paper coupon to take into your local Walgreen pharmacy click on this Walgreens pharmacy coupon here. You can use this printable Walgreens pharmacy coupon to get a $25 Walgreens gift card when you transfer your prescription to Walgreens.

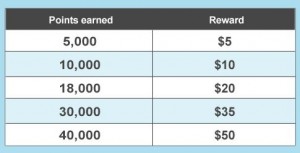

Check out our weekly Walgreens coupon match ups here. Walgreens has just started a new loyalty card program too and you can also get point that translate into cash when you have your prescriptions filled at Walgreens. Click here to read our Walgreens store guide.

“Payday loans are advertised as an attractive short-term option, but that does not reflect reality. Paying them off in just two weeks is unaffordable for some borrowers, who become indebted long-term,” Nick Bourke, Pew’s specialist on small-dollar loans, stated in a prepared statement.

The Community Financial Services Association of America, a group representing payday lenders, countered that the Pew report lacked context. “Short-term credit products are an essential fiscal instrument for individuals who want funds to cover for an urgent expense or manage a shortfall between paydays,” the organization stated in a statement. “In our present market and constricted credit market,” the statement continued, “it is important that customers possess the credit options they need to deal with their financial problems.” The typical fee charged by organization members, the statement mentioned, is $10 to $15 per $100 lent.

http://Cashadvanceloans54.com/, Lucia